Economic factors are influencing the CStore sector. How can convenience stores pivot to keep margins intact?

Convenience stores across the nation took a hit with channel growth in the first quarter of 2022. IRI, one of the leading consumer data aggregators, noted channel growth slowing to 1.7% with inflation and price/mix changes being the two biggest causes. While the economy is significantly impacting the CStore market, there are some bright spots appearing.

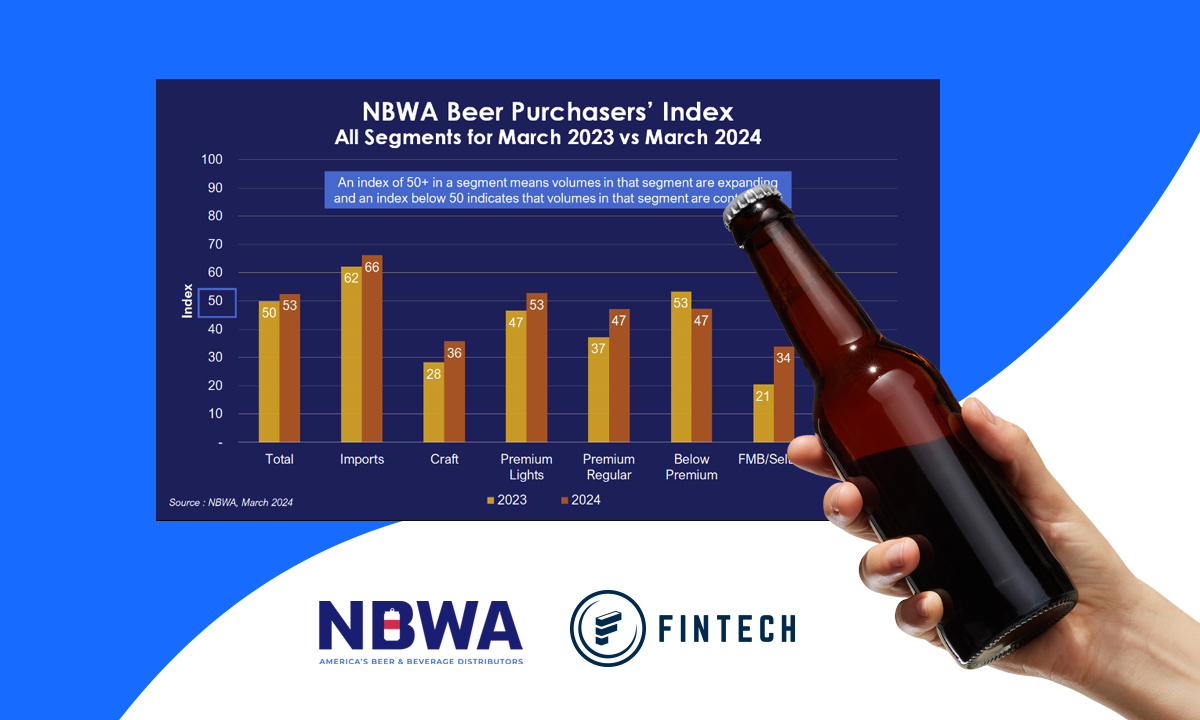

Sharp Decline in Cigarette and Beer Categories

Cigarettes and beer – categories making up 44% of total CStore sales – were significantly down in both sales dollars and volume. Inflation continues to grow, coupled with supply chain issues, and is hitting consumer wallets and shifting their spending habits.

Despite this change, premium cigarettes, premium beer, and imported beer were still on the Top 10 Selling list of items.

Some CStore Subcategories Showed Growth Over MULO Businesses

Convenience stores compete with MULO (multi-outlet) stores like food/grocery stores, drug stores, Walmart, club stores like BJs and Sam’s Club, and dollar stores like Dollar General and Family Dollar, for example. IRI’s Q1 data report showed that there was growth in sales for subcategories like general merchandise, candy, and prepared cocktails.

Convenience stores saw a 34.5% change vs. YA compared to MULO’s 27.6% for prepared cocktails. RTD (Ready to Drink) cocktails are becoming increasingly popular, especially in an inflated economy where consumers still look to spirits for their primary alcohol consumption but don’t want to go out to on-premise retailers.

This increase in sales, aligned with the convenience of the CStore shopping experience, indicates prepared cocktails as an area to watch for businesses looking to identify sales growth opportunities.

E-Commerce Providing Avenue for Expansion

One of the most exciting opportunities for CStores is the integration of e-commerce platforms, online ordering, and delivery. One example is 7-Eleven recently being honored for the Best Overall Digital Transformation at the Modern Retail Awards. They introduced a subscription delivery service known as “7NOW Gold Pass,” which waives delivery fees for members.

Many CStores already partner with DoorDash and other app-based delivery services to reach customers. Users can order all kinds of items, including alcohol, for delivery. CStores would be wise to continue investing in these e-commerce platforms and options to find new ways of expanding their customer base.

Looking to the Future

As Q2 performance reports are finalized and we move through Q3, it will be interesting to see how inflation affects CStore sales and operations. Convenience stores looking to optimize their alcohol management can look to Fintech’s PaymentSource for assistance. Fintech automates alcohol invoice payments and integrates line-item invoice data into hundreds of back-office systems used by convenience stores.