Automate Your Alcohol Invoice Payments with PaymentSource®

For over 34 years, we’ve automated alcohol invoice payments and data capture for retail and hospitality businesses throughout the U.S.. Fintech integrates with 200+ back-office systems, saving time and delivering powerful insights to protect margins.

Is Your Business in California?

There is a new EFT law that will require all wholesaler alcohol invoice payments to be made using electronic funds transfer (EFT), starting December 31st, 2025.

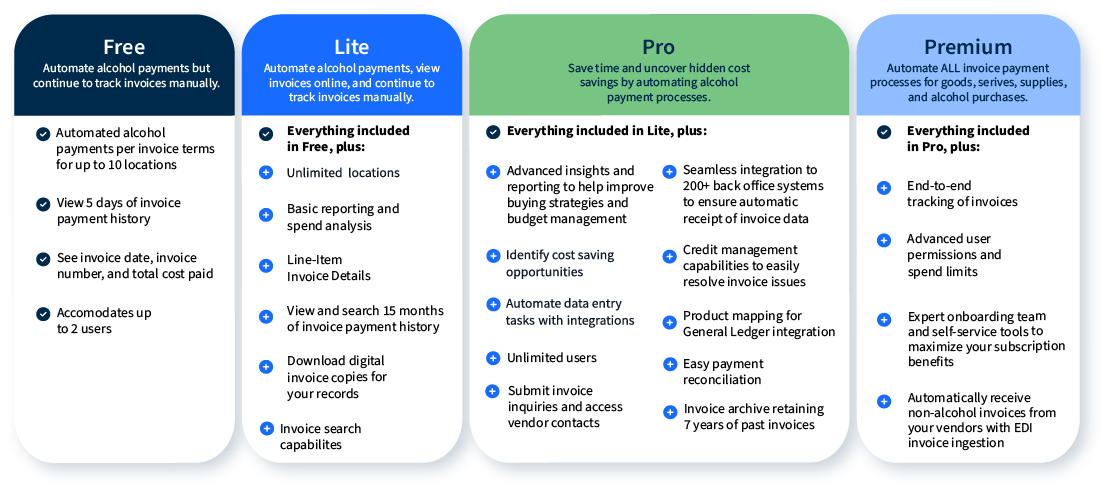

Levels of PaymentSource

We offer plans for all types of businesses, depending on your needs, designed to automate manual processes and enhance business efficiency. Each tier includes powerful tools and features designed to save time and optimize your operations with ease.

California Retailers!

Stay Compliant with the New EFT Law

The new CA law requires all wholesaler alcohol invoice payments to be made using electronic funds transfer (EFT) by December 31, 2025.

Here's why retail and hospitality businesses choose Fintech as their EFT provider;

- FREE service with self-sign-up feature

- Industry leader in alcohol invoice EFT payments

- Automated alcohol invoice payments based on the due date

- Comprehensive network of 360+ CA wholesalers

- Fully compliant with the new CA law

About The California EFT Law

Learn about Assembly Bill 2991.

Additional details about AB 2991 and how to get started.

How Fintech can help keep you compliant with AB 2991.

As of September 22, 2024, Assembly Bill 2991 has been signed by Governor Newsom. This bill requires all wholesaler alcohol invoice payments to be made using an electronic funds transfer (EFT). Cash, checks, money orders, and other forms of payment will be replaced by EFT.

What are EFT payments?

The law defines them as “the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions via computer-based systems.” It’s basically just an electronic version of a paper check.

Other notable clarifications to consider:

- California’s 30-day credit limits remain unchanged and at the wholesaler’s discretion

- Electronic payments include credit cards – but the retailer must pay the transaction fee for each credit card transaction

- Wholesalers and retailers must pay their own costs for EFT services (neither party may pay for the other)

- Wholesalers must initiate the payment process

- Wholesalers will be responsible for selecting which third-party payment platforms they use, but there is an exception for retailers already using a third-party payment platform

Testimonials from Our Clients

“If we need to have a sale on a SKU that isn’t moving, or increase stock levels at certain locations, Fintech insights are very helpful. For upper management, they can easily see what items are more relevant to certain areas.”

Catherine Williams

Office Manager, Zipps Liquor

Connect with Our Team

Complete the form below to learn what other automations PaymentSource can provide for your business.