Meet Fintech at Booth #6067

Fintech has developed new automation capabilities for our restaurant clients. Click the button below to set an appointment with our team at the NRA Show to learn more about how these new capabilities can improve operational efficiency at your restaurant.

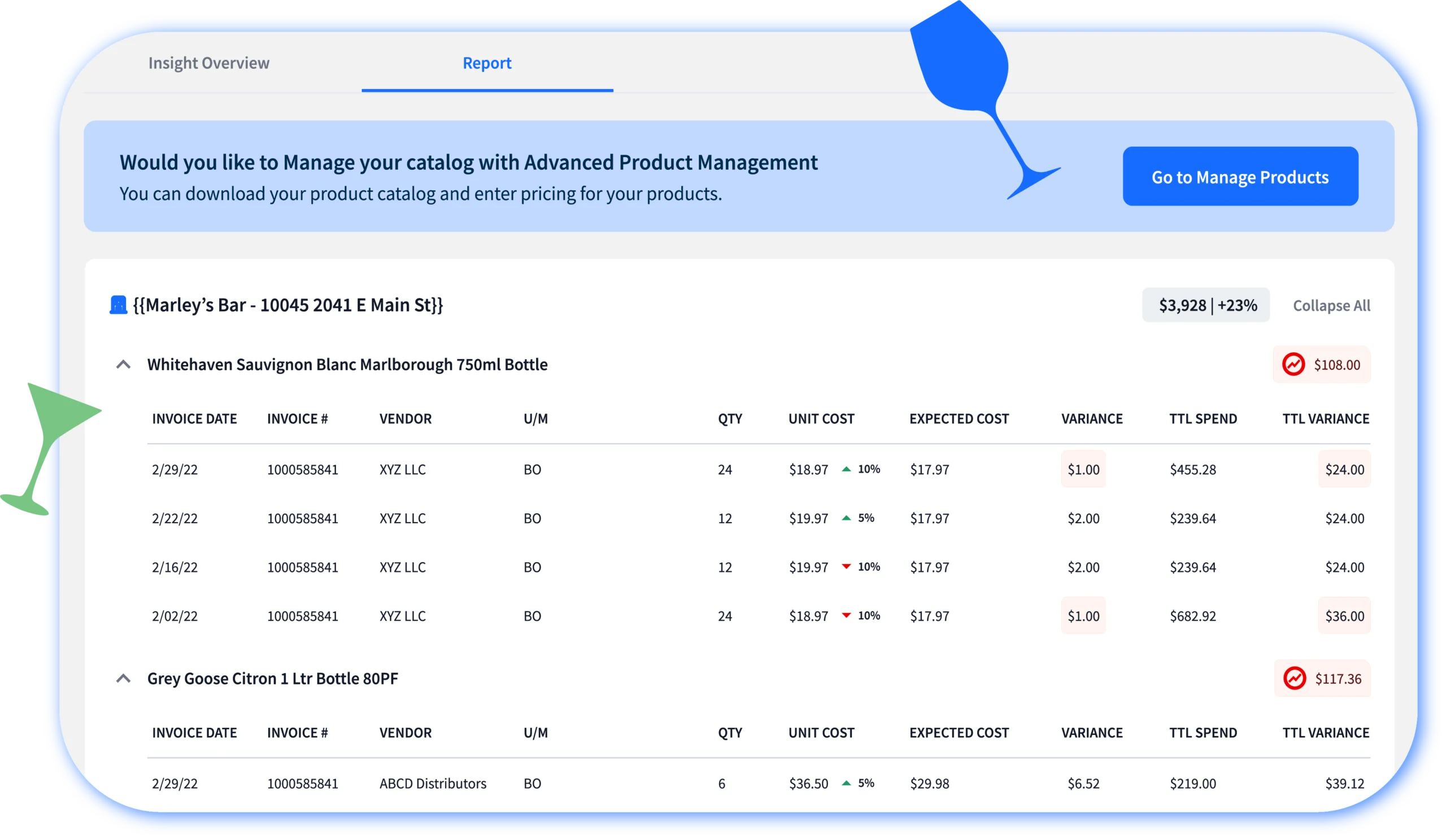

Stop Overpaying for Alcohol with Expected Cost Analysis

Comparing Expected to Invoiced Costs is Now Automated

We are creating several new compliance modules that live within your Fintech portal. These modules use automation to help you monitor compliance adherence across different areas of your business.

The first one now available is Expected Cost Analysis, which compares what you would expect to pay for a product against the cost on the invoices you process through Fintech. Any cost higher than the expected amount in your product catalog will be flagged, allowing you to determine where you need to adjust pricing or negotiate with vendors to stay within margin targets.

A $1 pricing error per bottle could cost you thousands over a year.

Automating the process of tracking pricing discrepancies helps you react faster to protect margins.

A $1 pricing error per bottle could cost you thousands over a year. Automating the process of tracking pricing discrepancies helps you react faster to protect margins.

AP Automation for Hospitality Businesses

PaymentSource® Premium

Our Premium offering captures ALL your vendor and distributor line-item invoice data and delivers it seamlessly into your back-office system. This expanded AP automation functionality also allows you to manage all invoices, not just the alcohol ones, in one place – the Fintech portal.

- Realize inventory purchases quickly

- Eliminate time-consuming, complicated invoice data entry

- Fintech manages all your vendor integrations

- Receive one file from Fintech with all your invoice data across your vendor network

- Vendors without e-invoicing capabilities can use our free Invoice Builder

- Scan and upload capabilities with OCR technology are available for small business operators

Watch our video to learn more.

PaymentSource Premium FAQs

What do I have to do to set up invoice data processing for my non-alc invoices?

First, we set up Fintech-vendor integrations with the vendors that will create the most efficiency for you. Just like we do with your alcohol invoices, we send all the invoice data together in one electronic file to your back-office system. Once you experience the efficiencies this brings, we can work with you to continue to add more vendors.

What does the integration setup process entail for vendors?

After initiating contact with your vendors, our Integration Setup team handles file type selection for data transfer, testing and maintenance of the integration, quality assurance, and turning the integration on so your vendors can send their invoices to Fintech directly.

How long does it take to set up an integration through Fintech for our vendors?

Once the vendor approves the integration with Fintech, it only takes a few days.

How does Fintech capture my non-alc invoice data?

In three convenient ways;

1) Just like we capture your alcohol invoice data from your distributors, we will set up an integration with your non-alc vendors to receive your invoices.

2) If a vendor doesn’t have integration capabilities, they can use our free Invoice Builder tool inside the Fintech portal to create a digital invoice and upload it from there.

3) Our OCR technology allows smaller retail and hospitality businesses to scan and upload non-alc invoices from a mobile device.

Does Fintech already work with some of my non-alc vendors?

We work with close to 300 non-alc vendors today. We will take your vendor list and compare it against who we currently work with and develop a vendor rollout plan.

What happens with the invoice data once captured?

All invoice line-item data is standardized and coded according to your preferred GL codes, sent to your back-office system, and populated in your personalized Fintech portal, providing one source of truth for all your vendor invoices.

How do I get the vendor invoice data back into my system?

After we ingest the invoice data and apply your GL codes, the data is delivered to your back-office system in a daily file through your integration with Fintech. You can also receive the daily file via email and upload it into your back-office system.

How much experience does Fintech have managing vendor integrations?

We are experts in integration management with decades of experience. We currently ingest data from over 250,000 invoices daily.

Do I have to pay my non-alc invoices through Fintech?

That’s up to you – you have complete control of how you pay your non-alc invoices. You are not required to pay your non-alc invoices through Fintech and can use us for invoice data processing only.

If I need a copy of an invoice, can I get that from Fintech instead of my vendor?

Yes. Your personalized Fintech portal acts as an ‘invoice vault’ housing 15 months of rolling digital invoice history.

Testimonials from Our Clients

Connect with a Fintech Team Member to Learn More