Three tactics to keep your staff and customers safer.

The unprecedented and unpredictable spread of COVID-19 has undoubtedly changed the way off-premise businesses will operate in the United States for years to come. While alcohol sales have remained high, likely due to consumers stocking up for their self-quarantine, owners and operators have been faced with a new reality for service – they must commit to quick, clean service now more than ever. No matter how you’re choosing to adjust to a new normal, keeping your stores safe has never been more important. Implementing these three tactics could set your store apart for both the safety of your staff and the security of your customers.

Eliminate the unnecessary handling of cash

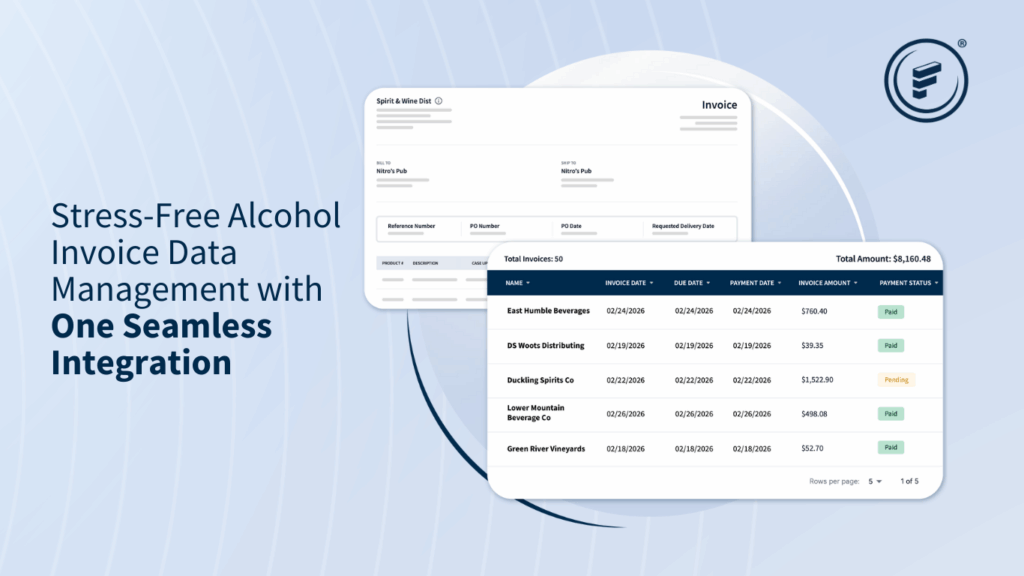

Even before the outbreak of COVID-19, the world was shifting to a cashless environment – now, it seems that this initiative may be more important than ever. While it may seem like a daunting task to eradicate the human-to-human exchange of cash, your locations can take steps to reduce the necessity across different parts of your business. Start by moving to electronic payments for your stores’ product deliveries. For example, providers like Fintech enable you to eliminate the exchange of cash, checks, or money orders for your alcohol deliveries and pay all your invoices electronically. By doing so, you not only protect your staff and the delivery drivers, but you speed up deliveries and allow your teams to maintain proper social distancing protocol. Plus, by automating payments for your products, your locations no longer need to manage multiple money orders or large checks for their purchases, further reducing their exposure to high-traffic machinery.

Research without paper invoices

We all know how frustrating it can be to dig through filing cabinets for paper invoices when you have a simple question, and now there’s an added concern of how many hands have touched that piece of paper. But, by moving to electronic payments for your stores’ deliveries, you can also reduce the exchange of paper invoices. Many electronic payment providers also grant users access to an online portal to view invoice information, so your teams can easily research invoice amounts or credit inquiries without touching filing cabinets, desk drawers, or pieces of paper. Fintech’s online portal, for example, displays each invoice, broken down by line item detailing product names, UPCs, amounts, and even credits. Plus, this portal is accessible by computer, tablet, and even cell phone, so each user can access the information on their own device, without spreading germs. Electronically storing invoices gives your teams a safer way to research, and it reduces the amount of time they spend behind the desk, so they can get back to serving your customers quicker.

Reduce other hand-to-hand exchanges

Obviously, simply eliminating cash in both the front of your store and the back will not remove all needs to exchange paper from hand-to-hand. With the alcohol deliveries mentioned above, deliveries often result in paper invoices that are then shifted to a desk or filing cabinet, then keyed into a computer manually. But, by automating payments, your team can also automate the maintenance of invoices, so they don’t even need to handle paper copies. Through systems like Fintech, your alcohol invoice data is automatically imported directly into your back-office system with zero person-to-person contact. To follow this same path for the front of your store, consider moving any rewards or coupon programs online, and offer consumers the opportunity to receive receipts electronically.

With the outbreak of COVID-19 and the increased consumer desire for safer, quicker places to escape their quarantines, stores across the country are facing a new reality for their locations. But, by staying on top of CDC recommendations and reducing human-to-human contact wherever possible, your stores have an opportunity to continue serving customers without sacrificing quality or profits.

Interested in learning more about Fintech’s automated, electronic alcohol invoice payment solution or the topics covered in this blog? Contact us at 800.572.0854 option 3 and see how we can help your businesses through COVID-19.