For Retail Stores of All Sizes

Automating Invoice, Inventory and Vendor Data Management

Fintech has led the way in automating alcohol invoice data and payments for over 35 years and has a network of more than 7,800 alcohol distributors, vendors, and supply chain partners. Today, that same automation efficiency now extends across all product categories, with added inventory and vendor data management solutions for general merchandise and other non-regulated goods.

Trusted by Over 292,000 Businesses

Our Retail Products

Inventory & Vendor Data Management

Eliminate inventory holding costs and shrink with a consignment selling solution. Adapt rapidly to clients’ demand, drive sales growth, and achieve significant cost savings.

AP Invoice Automation

Automate all your invoice processes for goods, supplies and alcohol. Gain insights with our user-friendly portal, offering comprehensive reporting on all invoice data to safeguard your margins.

New Module: Expected Cost Analysis

Automatically compare what you would expect to pay for a product against the cost on the invoices you are processing through Fintech. Learn more about this report.

For Mid-size and Enterprise Retail Businesses

Consignment selling with Scan-Based Trading. Only pay for what you sell.

Free Up Cash Flow and Reduce Shrink

With Scan-Based Trading (SBT), you only pay for what you sell—transforming how you manage inventory and protecting your margins.

- Eliminate upfront inventory costs and free working capital for growth

- Reduce stock surplus and out-of-stocks on shelves

- Minimize shrink losses with item-level visibility at point of sale (POS)

Keep Up with Customer Demand

Traditional inventory models often leave retailers with overstocks or empty shelves. SBT enables agility to respond to shifting customer preferences.

- Leverage POS data for real-time insights by SKU and location

- Forecast item replenishment more accurately with supplier collaboration

- Replace underperforming products with high-demand items to maximize sales

Simplify Operations and Save Time

Manual inventory and payment processes drain resources and lead to errors. SBT automates and streamlines back-office workflows.

- Automate supplier payments and reconciliation

- Proactively detect discrepancies for faster issue resolution

- Reduce time spent on receiving, managing, and forecasting inventory

Scale Without Added Back-Office Strain

Growing your retail business shouldn’t mean adding more manual processes or staff. A third-party SBT platform gives you the support to expand confidently.

- Simplify and speed up supplier onboarding with established connections

- Standardize invoice data across all vendors for consistency

- Gain a neutral, audit-ready platform that supports long-term growth

Invoice Processing Automation for Retail Businesses

We all share common challenges and best practices, whether you have one location or one thousand.

Benefit from Free, Lite, Pro, and Premium plans of PaymentSource.

Capture Your Retail Store Invoice Data

Eliminate Time-Consuming, Manual Invoice Data Entry

When you integrate with Fintech, we standardize and code your invoice data before sending it to your back-office system in the format you require. This integration eliminates manual invoice data entry for goods, services, supplies, and alcohol purchases. Reduce the possibility of human errors and save up to 10 minutes per invoice on data entry alone.

Benefit From Three Ways to Digitize & Standardize Invoice Data

After data is received and standardized, we populate it inside your personalized Fintech portal and can also send it to your back-office system through an integration or daily file.

We ingest invoice data in three convenient ways:

- Directly from your vendors, suppliers, and alcohol distributors through an integration

- Through Fintech’s Invoice Builder – where vendors without electronic invoicing can create and upload digital invoices inside our portal

- Use Fintech’s Quick Capture to scan and upload the paper invoice in minutes - AI and machine learning digitize and code line-item invoice details

Avoid Financial Reporting Bottlenecks

Since Fintech sends all your invoice data to your back-office through one integration, the data is captured timely, ultimately allowing you to realize inventory expenses consistently faster. This helps eliminate month-end delays, giving you accurate numbers to reconcile against to close financial periods confidently.

Never Lose Track of Your Purchase History

Need to find an invoice? It’s stored in your secure Fintech “invoice vault.” Your portal keeps a rolling 15 months of purchase history across all vendors, suppliers, and alcohol distributors—giving you quick, reliable access whenever you need it.

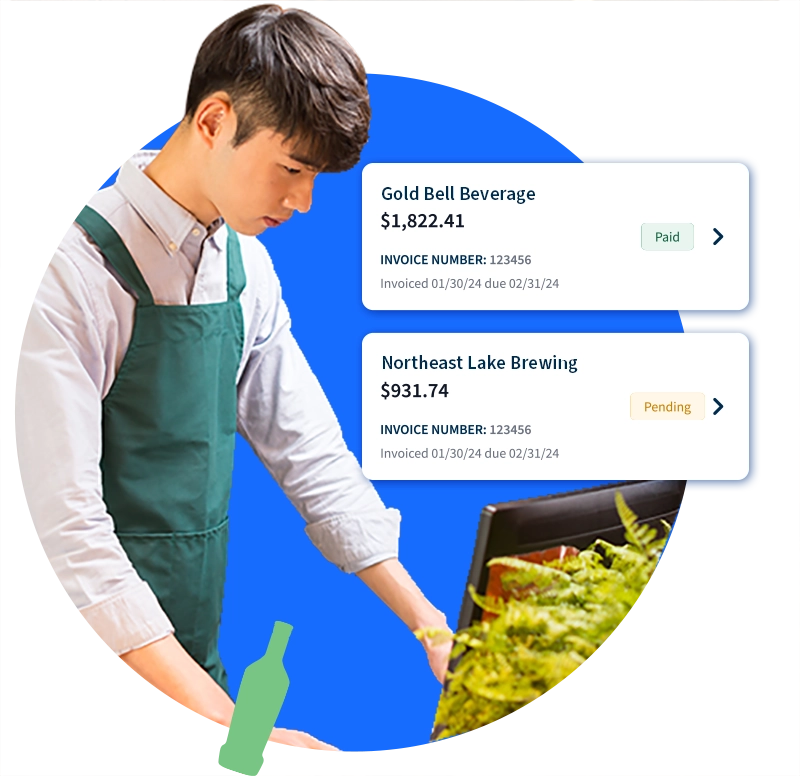

Simplify Retail Store Invoice Payments

Automate Regulated Alcohol Invoice Payments

Whether you operate in a state that requires COD for alcohol purchases, offers terms, or a combination of both, Fintech’s PaymentSource automates the invoice payment and keeps you in line with state regulations. Payment is made per the due date on the invoice, and all payments can be monitored inside your Fintech portal. You also have the option of scheduling alcohol invoice payments before the due date if preferred.

If you would like to sign up for automated alcohol invoice payment only, you can sign up here for our Free service and receive a no-obligation trial of all portal benefits.

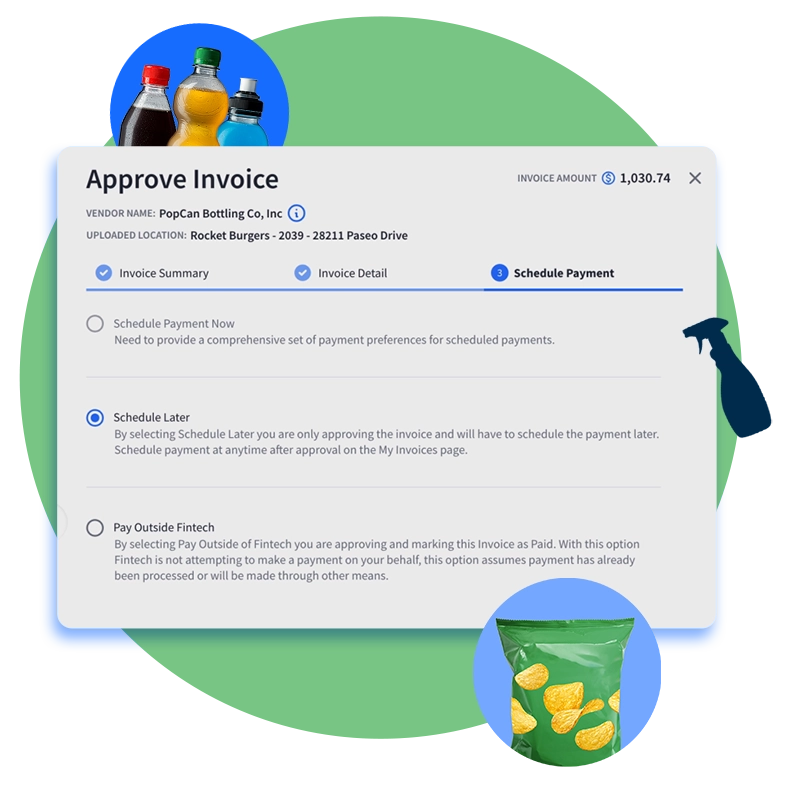

Pay Your Way for Other Goods* & Supplies

Manage vendor payments with the flexibility to pay invoices inside the Fintech portal—or continue using your existing AP processes while still receiving clean, standardized invoice data in your accounting system.

In the portal you can:

- Submit payments via ACH or check directly through the portal

- Automate vendor payments using customizable due-date rules

- Maintain current payment workflows while Fintech delivers structured invoice data

*Applies to non-regulated goods and services. Invoices with state-mandated payment requirements, such as alcohol, must be processed using Fintech’s compliant alcohol payment automation.

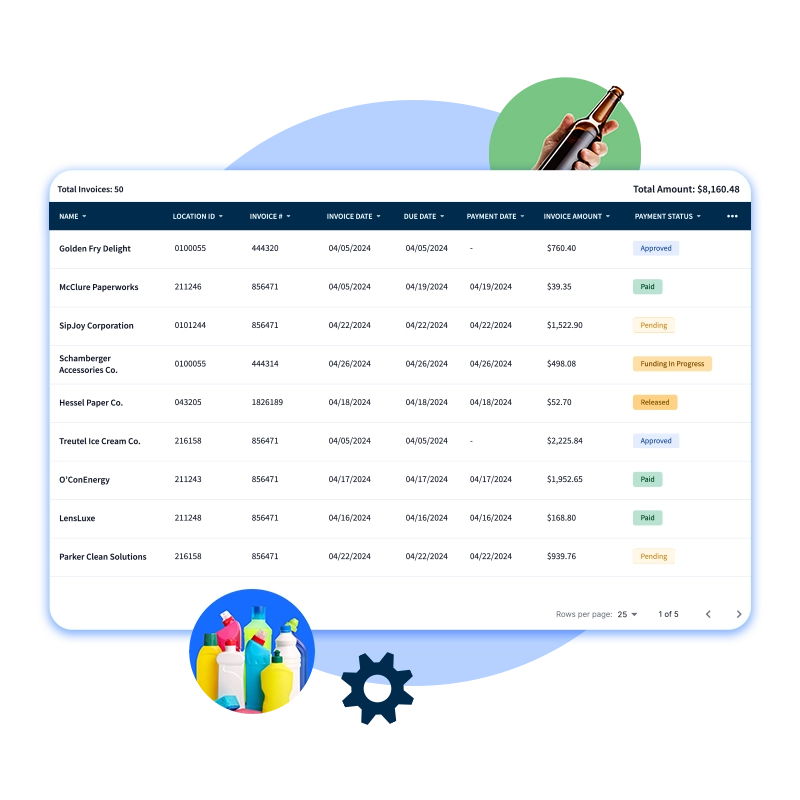

One Platform with Reporting & Insights for All Your Retail Locations

Whether you run a small chain or an enterprise, your Fintech portal is a centralized collection point for all vendor and distributor invoices. Create a single source of truth across all your locations with access to purchase data, reporting, and insights.

- Beverage program compliance

- Product catalog management

- Spend by category or vendor

- Cost variance tracking

- Top-product reporting for alcohol purchases

- And more insights to protect margins

Learn more about expanding controls over governance, compliance, and reconciliation across invoice management with ReconSource® and OrderSource®.

Browse PaymentSource Product Pages

See PaymentSource in action. Dive deeper into our product pages and portal screenshots to understand how invoice processing, payments, and reporting come together for retail businesses.

Explore Our Blog Insights that Help Retail Businesses Grow

Request a Demo Today

Complete the form to connect with a Fintech team member about our retail business solutions.