Receiving an invoice from your alcohol distributor is the first step in the long process of managing invoice data. Once the delivery is confirmed, many operators manually key all the invoice data into their back-office or accounting system. This means taking each invoice from each delivery and spending hours entering everything in, coding all the products for accurate reconciliation, and double-checking that they were charged the right cost for each product delivered.

Fintech’s PaymentSource® Pro transforms this process through seamless data integration, offering a smarter, faster, and more accurate way to handle invoice data. From the moment the invoice is received to the moment the invoice is uploaded into your back-office system and everything in between, Fintech has you covered.

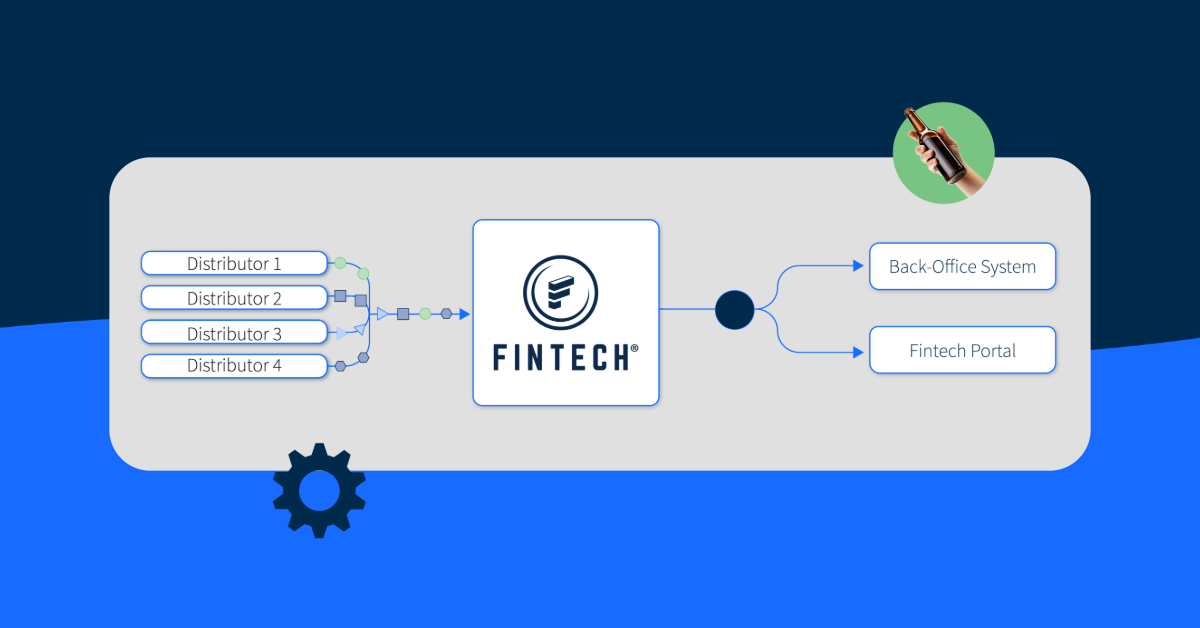

The Invoice Data Processing Lifecycle

Step One: Invoice Ingestion from Distributors

The integration cycle begins when Fintech receives an invoice directly from your alcohol distributor. This is done through a secure, automated data connection with each distributor that eliminates the need for manual invoice data entry and the possibility of missing invoices, affecting reconciliation. By Fintech ingesting invoices electronically, you can ensure that data is captured quickly and accurately from the source.

Step Two: Standardizing Invoice Data

Once Fintech receives the invoice, the invoice data is standardized. Distributors often use different formats and terminology, which can make manual processes even more challenging. Fintech converts the invoices into a uniform format, regardless of the distributor’s original layout or terminology. Standardization is essential for consistency, especially when dealing with multiple distributors that all have their own product descriptions. No matter which distributors the invoices come from, Fintech standardizes the data in the same format with consistent spelling, naming conventions, and product pack descriptions.

Step Three: GL Coding for Internal Alignment

Next, Fintech automatically GL codes the invoice for you. By mapping each line item to the appropriate GL code, you can ensure accurate inventory and financial reporting and simplify downstream accounting processes.

Step Four: Delivery to Your Back-Office System

Finally, Fintech delivers the fully processed invoice—now standardized, coded, and stored—directly into your back-office system. This integration enables seamless reconciliation, reduces the risk of data entry errors, and ensures that financial systems are always up to date. You can capture clean, line-item invoice data without manual intervention.

Step Five: Populate the Invoice Data in Your Fintech Portal

After Fintech standardizes the data, a digital copy of the invoice is stored in your Fintech portal, essentially acting as an “invoice vault.” This centralized storage provides easy access to 15 months of historical invoices, making it easy to locate past invoiced purchases as needed through a searchable archive. While many alcohol regulations require you to keep the original physical copy of an invoice, a digital invoice vault provides a reliable method for internal research and bookkeeping.

This digital storage sets up other capabilities with your invoice data. For example, Fintech aggregates this invoice data and analyzes purchasing insights to track your top spend by product, spend by distributor, and more. These reporting features allow you to make margin-protecting decisions faster.

Why Should You Implement Automated Invoice Data Integration?

Implementing invoice data integration with Fintech’s PaymentSource® Pro offers a range of benefits:

- Time Savings: Automating alcohol invoice data capture significantly reduces the hours spent on manual data entry.

- Improved Accuracy: Standardization and GL coding minimize human error and ensure consistent data across systems.

- Faster Reconciliation: With invoices delivered directly to your back-office system, reconciliation becomes quicker and more efficient.

- Enhanced Visibility: The digital invoice vault provides easy and timely access to invoice history, supporting faster reconciliation.

Improve Your Invoice Data Management Through Automation

Fintech’s PaymentSource Pro is more than just a payment solution—it’s a powerful tool for transforming how alcohol invoices are managed. By automating the entire invoice lifecycle, from ingestion to reconciliation, you can save time, reduce errors, and gain greater control over your financial operations.