Convenience stores are showing some interesting signs of growth according to a report from Circana. Their data puts the YOY (year-over-year) convenience channel dollar sales growth at +4.7% in Q1 2023. It was previously sitting at +3.4% at the end of Q4 2022, so this positive trend bodes well for cstore operators. The multi-outlet (MULO) channel is still levels above in terms of YOY dollar sales growth (+7.5%, Q1 2023), but the report did point out the deceleration that occurred from Q4 2022 (+9.8%).

What’s the cause of this growth? Circana attributes it to the YOY increases in convenience channel shopper count and trips. More people, more often, means more sales. Operators can steady the rising tide of consumers with an automated tool like Fintech’s PaymentSource to streamline alcohol deliveries and pull purchase data insights to identify new margin-protecting opportunities.

Beer and Cigarettes

There was a 2022 trend where the convenience channel performed better than the MULO sector in terms of dollar sales % change vs. YA (year average) in both beer and cigarettes. The tobacco category in general is a major boon for cstores, though it is smokeless tobacco options that show the biggest dollar sales % change vs. YA.

Convenience stores have always been quick-stop options for beer. Turns out the term “convenience store” does speak for itself. This is evidenced by the wide range between the convenience channel and MULO for beer in this category – +5.3% vs. -0.2% in Q1 2023, respectively.

That’s a lot of beer deliveries to keep up with the demand. This means more paper invoices and time spent in the back office manually inputting line-item data to keep margins intact. Fintech lifts that burden for operators by automating payments per the terms of the invoice. It can also deliver line-item directly into a back-office system, like CStorePro or PDI, so operators can save time and have faster access to their purchase data.

Shopper and Location Trends

From the report, both shopper and trip count in the convenience channel are continuing their trends of YOY growth. An interesting note from the report is the type of consumer coming into the convenience channel. The upper-income tier of consumers saw the greatest YOY growth in trips for Q1 2023. Circana defines “upper tier” as greater than $70k for one person.

All three tiers – lower, middle, and upper income – all reported increases in trips % vs. YA from Q4 2022 to Q1 2023.

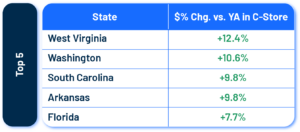

As for where these trends are showing the most impact, the report highlighted the top 5 states for dollar growth in Q1 2023:

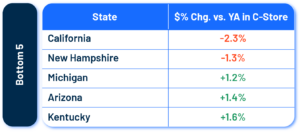

It also highlighted the bottom 5 states as:

Keeping the Convenience Channel Open

Whether these positive trends continue over the remainder of 2023 remains to be seen, but cstore operators can take steps to capitalize on the moment and retain customers. Managing price and promotions for beer is one way to keep margins intact. Fintech can help in this area with price trend reports that show operators how to capitalize on certain buys from their distributors.

Another way Fintech can help is with time savings. Fintech’s automation frees up time that would be otherwise spent handling alcohol deliveries or in the back inputting line-item data. With these manual processes handled by Fintech, operators can reinvest their time and resources into other areas of the business.

Over 50,000 cstores use Fintech to manage their alcohol invoice payments. Learn more about how Fintech can transform alcohol management for convenience stores here.