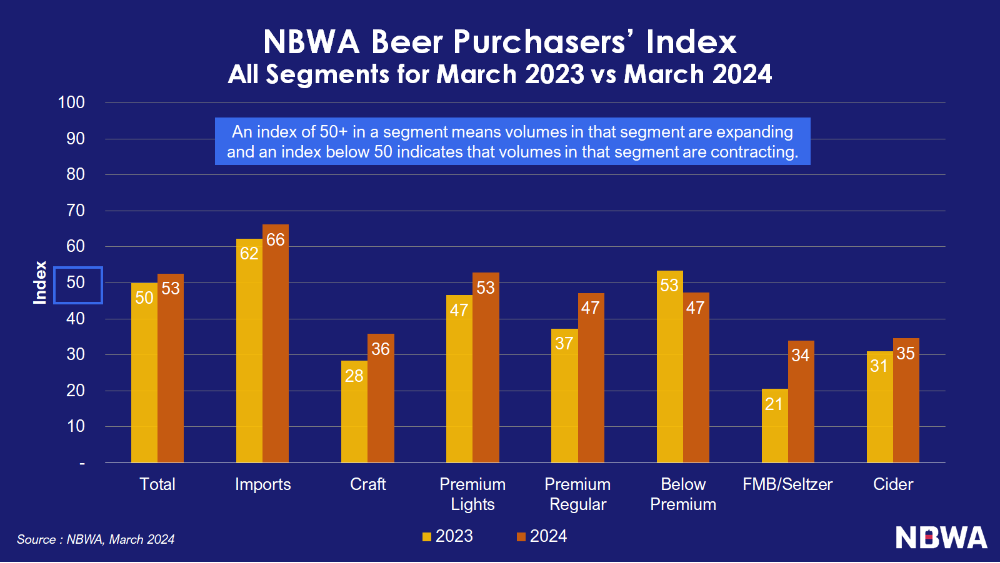

Our friends at the National Beer Wholesalers Association (NBWA) recently released their Beer Purchasers’ Index (BPI) for March 2024. Beer had a subtle start to the year, but March’s numbers showed distributor ordering levels on the rise at 53, the highest March BPI mark since 2021.

Note: A BPI reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

The BPI is compiled by Lester Jones, NBWA Vice President, Analytics and Chief Economist, and is an “informal monthly statistical release giving distributors a timely and reliable indicator of beer purchasing activity.” NBWA surveys beer purchases across different segments and compares their year-over-year performance.

Looking at the Data

The seven major beer segments the BPI measures are:

- Imports

- Craft

- Premium Lights

- Premium Regular

- Below Premium

- FMB/Seltzer

- Cider

Six of these seven categories show increased YoY ordering volumes. BPI readings include 66 for Imports compared to last year’s 62, 36 for Crafts compared to 28, 53 for Premium Lights compared to 47, 47 for Premium Regular compared to 37, 34 for FMB/Seltzer compared to 21, and 35 for Cider compared to 31. The only category that registered lower than last year’s performance was Below Premium, with a BPI of 47 compared to last year’s 53.

What does this data show? It shows that imports continue to show expanding volumes. It shows that while Crafts are still in contracting territory, they are trending in the right direction toward expansion. In fact, the Craft segment had its highest non-summer season (May-August) ordering levels since April 2022. Both the Premium Regular and FMB/Seltzer segments saw double-digit jumps, signaling the strongest growth of all the segments.

A Continuation of What’s to Come

These growth indicators are continuing the trend outlined by Jones’s economic analysis. Jones and Fintech’s Eric Kiser (VP, Distributor Strategy) recently hosted a webinar covering the beer market’s performance using Fintech’s retailer purchase data, which represents an anonymized aggregation of beer purchase data among 225,000 retailers (115,000 on-premise/110,000 off-premise) and 5,100 distributors. Fintech’s data covers chain and independent alcohol industry retailers across all 50 states and D.C. and comes from the over 950,000 Fintech processes weekly – about 1/3 of all retailer alcohol purchases.

In the webinar, Jones pointed out that on-premise retailers spent approximately $400 million more on beer in 2023 than in 2022. This figure, coupled with NBWA’s March 2024 BPI, indicates a potential upward trajectory for the beer category, opening the door for revenue growth opportunities.

Using the Right Tools to Ride the Wave

Distributors can capitalize on the beer market’s trend with the right tools. Fintech maximizes operational efficiency with automated payment collection, saving an average of 15 minutes per stop at each retailer. These time savings also reduce driver check-in times and eliminate manual processes for your accounts receivable team. There is the distributor E-vite tool, which helps distributors seamlessly enroll new retail accounts in electronic invoice payments. Best of all, by enrolling with Fintech for automated invoice payments, there is more retailer purchase data to aggregate, painting a clear picture of the beer market.

Another great tool for distributors is NBWA! Click here to find more information about joining NBWA to gain exclusive access to industry resources, insights and programs. Be sure to keep an eye out for NBWA’s next Beer Purchasers’ Index release to stay in the know of what is happening in the world of beer.