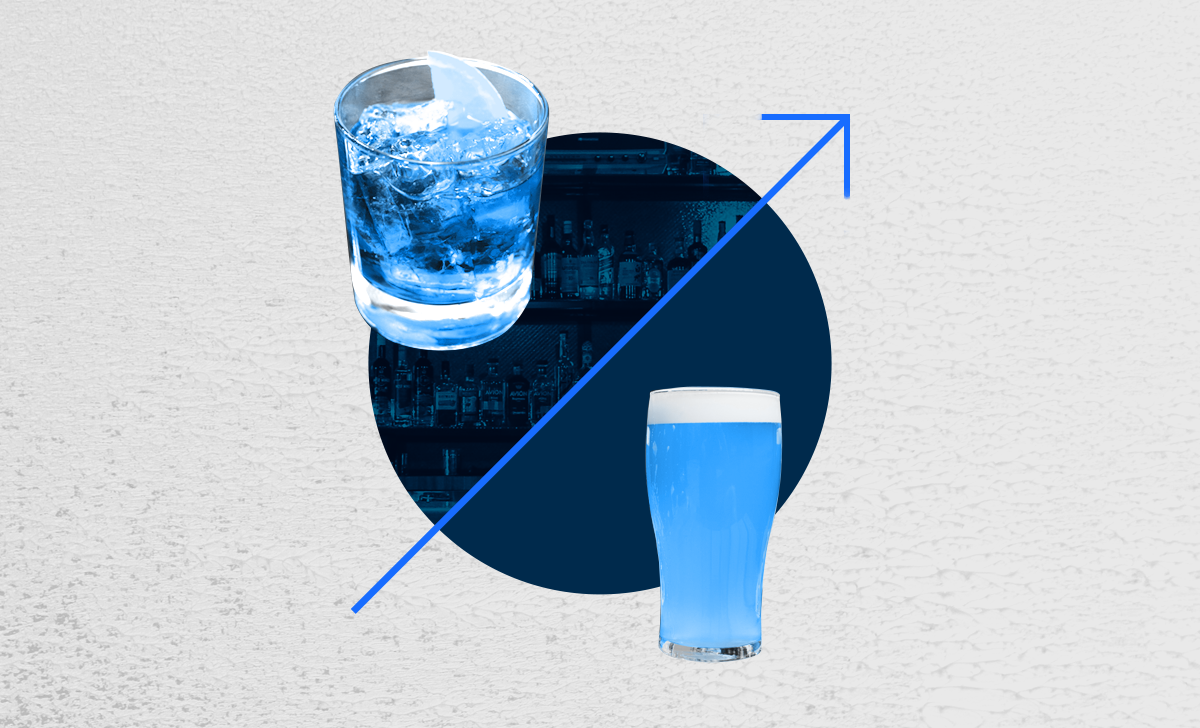

According to the Distilled Spirits Council of the United States (DISCUS), the U.S. spirits market share has overtaken beer. From 2000 to 2022, the spirits revenue market share has gone from 28.7% to 42.1%. DISCUS reports that beer has a 41.9% market share. The organization recently held its annual conference in Chicago where they assessed spirits trends and how they are impacting the beverage alcohol industry.

Chris Swonger, president and CEO of DISCUS, lauded the resilience of the spirits industry in spite of labor shortages, inflation, and supply chain issues. He credits this resilience to the spirits industry’s increased market share.

“This is a great American success story,” he said. “We’re focused on continuing to stay ahead through perseverance and by ensuring all of the positive trends we’re seeing.”

Celebrity-Backed Brands Taking Over the Liquor Market

There has been an increase in celebrities investing in the spirit industry. Some notable examples include Kendall Jenner’s 818 Tequila, Ryan Reynolds’s Aviation Gin, Dwayne “The Rock” Johnson’s Teremana Tequila, and George Clooney’s Casamigos Tequila. Clooney sold the brand to Diageo, a global leader in beverage alcohol, for $1B in 2017. This transaction is often credited as the catalyst behind other celebrities getting into the mix.

Mark Wahlberg recently launched the tequila brand Flecha Azul and spoke on a panel at the DISCUS conference. He cited the success he saw in the celebrity tequila space as a driving force behind his decision to get into the liquor market. These brands carry an obvious star power, and some of their celebrity backers do a fantastic job of advertising. A familiar face can often be the tipping point for a consumer looking to try something new, so it will be interesting to see how many other celebrities get behind the movement.

Consumers Are Willing to Spend More on Premium Offerings

Another recent trend is the rise of premiumization with spirits. Consumers began buying higher-quality spirits during the COVID-19 pandemic, leading to a 4% rise in luxury brands according to DISCUS. Ready-to-drink cocktails (RTDs) also opened other lanes for at-home consumption and for revenue with distillers.

This demand has led to an increase in sales. The DISCUS data shows that tequila sales rose 21% and whiskey hit 19% growth in 2022. DISCUS also highlighted spirit-based RTDs for having a 35.8% increase in sales – to the tune of $2.2 billion – in 2022.

What is contributing to this rise? One crucial element is diversification. More distillers are creating pre-mixed canned cocktail options to satisfy people’s varying tastes. You can now skip the long waits at bars and opt for a canned version of classic cocktails like mojitos, margaritas, palomas, and more. As brands expand their portfolios, the spectrum of options grows and consumers have more options to consider.

No-Alcohol Alternatives

By this point, it is no secret that non-alc beverage options are surging in popularity. Consumers, particularly younger consumers, are embracing the sober-curious lifestyle. Major brands like Anheuser-Busch, Molson Coors, and Heineken have all introduced zero-alcohol options into their portfolios. IWSR Drinks Market Analysis noted a 7% rise in volume across 10 global markets in 2022 for non-alc beers, ciders, wines, spirits, and RTDs. IWSR also projects that “non-alcoholic RTD products in the US will grow by 18% in volume between 2022 and 2026.”

These non-alc options typically combine natural and botanical flavorings. Fresh juices, syrups, creams, and blends of herbs and spices all come together to create unique tastes that mirror their alcoholic counterparts. Distilleries and other alcohol producers are wise to get in on the sober-curious movement and there will certainly be more products available as this category expands.

Paying Attention to Social Initiatives

As with any product, consumers yearn for a connection to the brands they purchase. There are a lot of factors that go into purchasing behaviors outside of just the product itself. Sustainability, diversity, and community involvement all resonate with modern consumers, and alcohol brands are highlighting these areas to appeal to them.

Whether it is eco-friendly packaging, sustainable brewing and distilling practices, or using locally sourced ingredients, alcohol brands are taking steps to improve their environmental impact in regard to their business model. Sustainability is practically considered a default for modern brands, as consumers will often opt for a brand they know is making good-faith efforts toward creating a better industry.

The spirits world is also embracing the importance of DEI (diversity, equity, and inclusion). There was a panel at the DISCUS conference exploring DEI leadership, promoting greater inclusion for a broader view of the market, and using data-driven metrics to track progress.

Successful brands prioritize these practices as much as creating a high-quality product for their customers.

Use Market Data to Get in on the Share

Adding more retailers is crucial to securing more of the market share. It can be hard for brands to stand out in a sea of competition, but there are tools available to help you expand. One such tool is Fintech’s Competitive Market Analytics (CMA) – a dashboard with off-premise retail sales data insights. CMA adds visibility to your market, and suppliers can easily track competitors and uncover trends. These insights build confidence in securing prime shelf space through data strategy and execution.

Distillers Can Optimize Market Share Expansion With Fintech

An increased market share means more sales. This applies to all three tiers of the alcohol system with sales on each individual level. What’s one way of creating efficiencies in managing increased alcohol payments? Implementing Fintech’s PaymentSource®. PaymentSource automates all spirits invoice payments and keeps them compliant with state regulations – all the way down from distiller to wholesaler to retailer. Users can also take advantage of data insights to protect their margins.