Consumer habits change rapidly, even more so now. Are you prepared for how they’ll affect your business?

Author: Anna Nadasdy, Fintech Director, Customer Success (InfoSource®)

*Data sourced from IRI Total US Multi-Outlet and Convenience, last 52 weeks through 12/27/20.

The key drivers that impact consumer behavior, particularly the economy, politics, and widespread natural disasters, have been especially active in the last year. With so much disruption in 2020, how consumers buy anything has been dramatically impacted. And there is no question that beverage alcohol sales have also been influenced – better for some and far worse for others. There was a major discrepancy in sales revenue among craft suppliers in 2020 – so who is winning, and what are they doing differently? Moreover, which camp are you in? How well did your business adapt to the dramatic shifts in buying behavior?

First, let’s dig a little deeper into some of the market trends we’re seeing and whether we expect these trends to continue into 2021:

Bars, restaurants, and taprooms across the country have taken a significant hit as consumers have been encouraged to stay home to avoid contributing to the spread of Covid-19. This has increased traffic and revenue in the off-premise space, particularly in stores where pantry-stocking could be achieved in one trip. Although regional discrepancies exist, without widespread vaccination, it’s likely we’ll continue to see a healthier off-premise and a lagging, if not long-suffering, on-premise segment. One interesting note: there is anecdotal evidence that check size has remained healthy, but, it hasn’t been enough to overcome more limited tables and turns.

In terms of what consumers are purchasing within the beer category, hard seltzers show little sign of a slowdown despite supplier challenges meeting inventory demand during the summer months. Flavored malt beverages (FMBs) have handily overtaken domestic sub-premium and craft to become the third-largest beer segment in dollar share (15.57%) and by far the fastest-growing, adding nearly three times more incremental dollars to the beer category than the second-fastest category – import ($2.8B v. $983M). If we home in on the cider segment specifically, we see that growth is healthy, up 10.98%, although still on a very small base. Interestingly, IRI elected to lump fast-growing and seemingly well-funded hard kombuchas into the cider segment. Though kombucha contributes to only five percent of the overall cider revenue, it’s the second fastest-growing micro-style and one to keep an eye on. (As we dove deeper into the cider category data, we wanted to narrow our focus to true ciders only, so we chose to take kombuchas out of the mix for the rest of our analysis.)

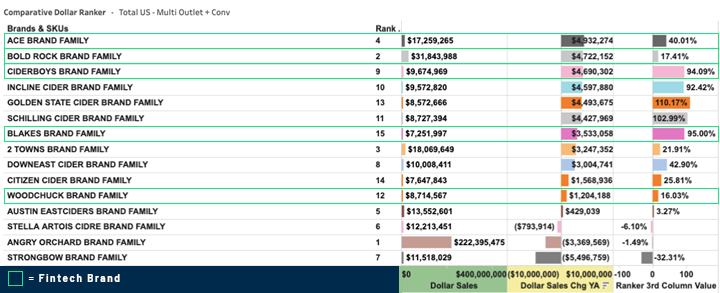

So, who’s doing well? Certainly, most of the larger brand families, with the notable exception of Boston’s Angry Orchard. With a 48% share of the cider segment, they lost $3.4M, more dollars than anyone outside of the Top 20 even generated. But only eight brand families out of the Top 50 were down, and most were up double- if not triple-digits. Keep in mind, we’re pulling this from consumer demand data that measures what is happening with chain accounts, so these are the brands that likely had already established availability in their local chains or else were very influential in pivoting to those outlets, given how buying behavior changed so dramatically. Digging deeper, Angry Orchard’s losses primarily came from their Rosé Hard Cider being down 44%. It’s tough to say whether that’s an indication that consumers are over their “Rosé All Day” phase – at least regarding cider. The varietal still tends to lead growth in wine; however, for every rosé cider down, there is another up. My hypothesis is that which flies high, falls hard, particularly when the flavor profile differs from the dry roses favored by wine drinkers. One notable departure from craft beer trends, where new SKUs from well-known brand families drove growth (ie. Blue Moon Light Sky, Elysian Contact Haze, New Belgium Voodoo Ranger Hoppy Pack, Lagunitas Little Sumpin Sumpin in a six-pack can), we had to get outside the Top 50 cider SKUs to find a new item (Ace’s Guava 4/6 can). Maybe innovation for cider took a backseat to FMBs for brands tied to beer houses in 2020.

Also, unlike other beer segment trends, we aren’t seeing as much “pantry-loading” with large pack sizes in cider. Growth continues for six-pack cans, four-pack cans, and large single-serve cans. Although the overall move toward cans is undeniable (and maybe unsustainable, given supply chain issues?), Angry Orchard’s size and continued reliance on bottles cloud the data. Once omitted, we find a clear preference for cans, with six-pack cans lagging six-pack bottle share by a mere tenth of a percent (27.81% compared to 27.92%).

Additionally, cider pricing is healthy, so there is really no need to discount at this time. The majority of six-packs are between $10 and $10.99, with the median at $10.34, more than $0.20 higher than craft beer counterparts. The brands in this price range have seen a 6.8% growth over last year, whereas those in the $9-$9.99 range have seen a 5.0% decrease. To bring this conversation full circle, the price range with the most growth is $15-$15.49 at +672.1%… 12 of the 13 brands in this range are hard kombucha.

Given this data, it’s easy for us to guess that your sales have been impacted one way or another. Could you have done things differently? Not necessarily. But maybe.

Developing a deep understanding of consumer behavior helps inform how you stay agile. These behavioral shifts are highly specific in nature and require sophisticated analysis. So, while you couldn’t have predicted how your business model would stand up to a once-in-a-lifetime pandemic, investments in knowledge and information can make you better suited to adapt in the future and help you make decisions that mean life for your business.

With that in mind, I want you to ask yourself – is your organization consumer-centric? Are your business decisions made with your customers in mind? Without consumer demand data at the heart of business strategy, how can you anticipate how you should be adjusting? Are you agile and equipped to respond to these consumer shifts? Customer-centric organizations consistently outperform those that are not across industries. Ours is no different.

In this instance, being consumer-centric equates to being data-centric. And since data is more accessible now than ever, who’s keeping their finger on the pulse? Our clients.