PaymentSource® for Retail & Hospitality Businesses

A Modernized Way to Process All Your Invoices

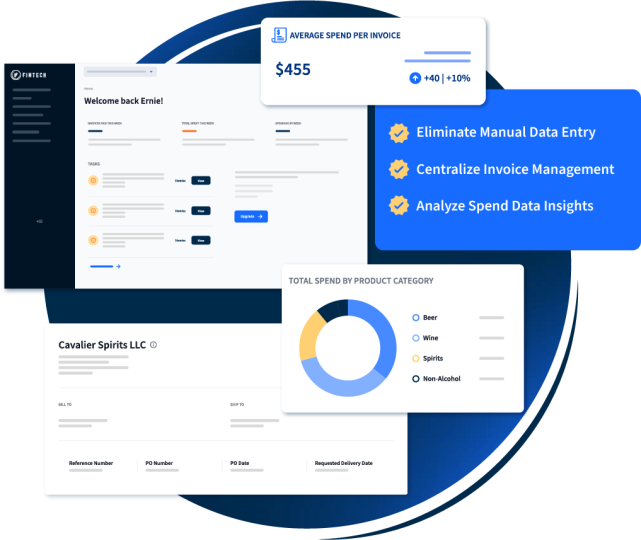

PaymentSource automates your AP processes—from capturing invoice data and paying invoices to reporting spend insights—for every vendor, distributor, and supplier delivery, including alcohol.

How PaymentSource Works

Invoice Data

Ingesting Invoice Data

Distributors, vendors, and suppliers with digital invoicing systems can integrate with Fintech to send invoices electronically through supported transfer methods and file formats, including EDI.

Trading partners without integration capabilities can still create and send digital invoices by using our free Invoice Builder tool. You can also scan or upload invoices in our portal using our quick-capture functionality.

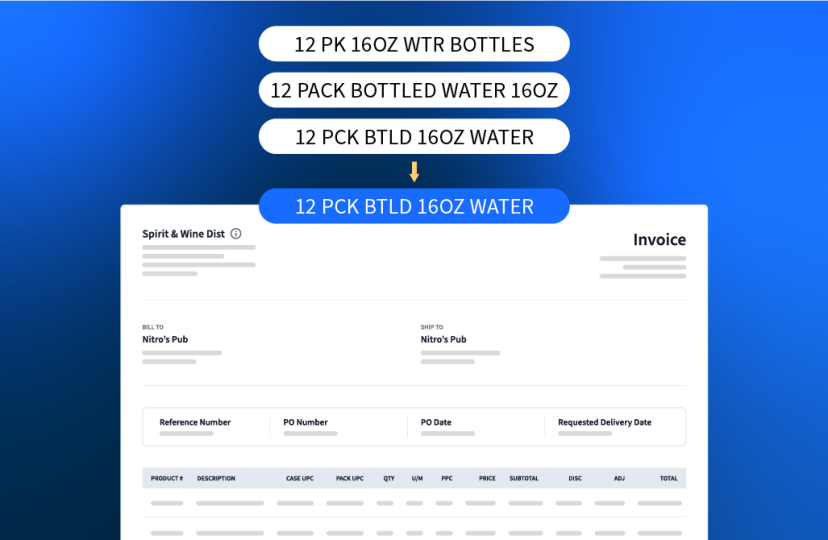

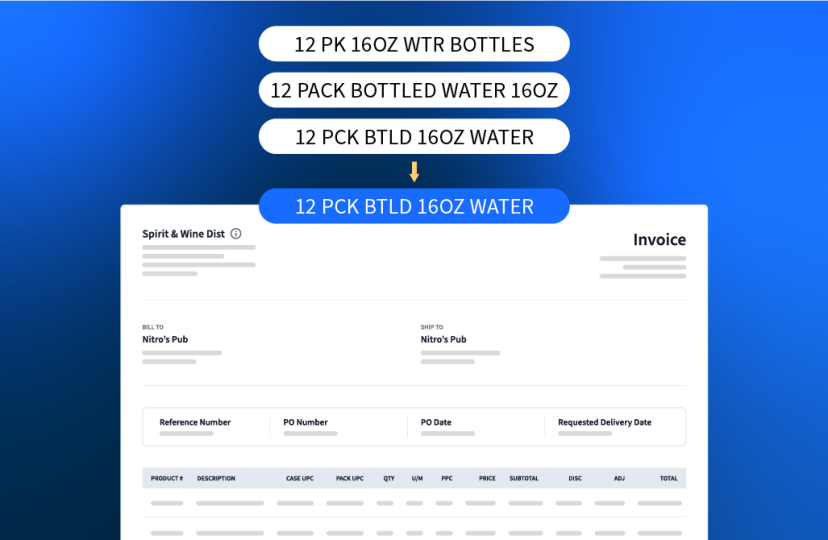

Standardizing & Coding Invoice Data

All invoices, regardless of how they arrive, are automatically converted into a standardized format. Products are GL coded and cataloged so your records are consistent across every vendor, distributor, and supplier.

Centralized Invoice History

Access every distributor, vendor, and supplier invoice in your Fintech portal. Gain access to 15 months of searchable invoice history, giving your team quick filtering, export, and reporting capabilities—all within a secure portal.

Back-Office System Integration

Finally, PaymentSource sends your clean invoice data directly into your back-office system in various ways from our pre-built integrations to a custom EDI file. This removes the need for manual data entry, reducing errors, and speeding up reconciliation.

Invoice Payments

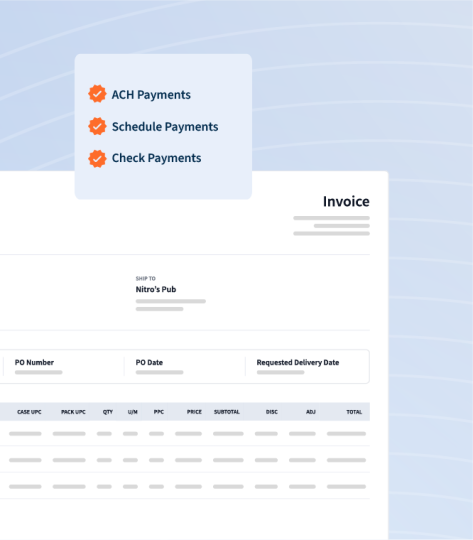

Pay Your Way for Goods* & Supplies

- You can make invoice payments via ACH or check in the Fintech portal, either manually or by setting up automated payments.

- You can also choose to handle payments in your accounting system outside the Fintech portal.

*This refers to non-regulated goods that don’t have state-mandated payment terms. Goods with state regulated payment terms such as alcohol can be processed through Fintech’s compliant alcohol invoice payment automation.

Automate Regulated Alcohol Invoice Payments

- Fintech automatically pays your alcohol invoices via EFT per the terms on the invoice to keep you compliant with state regulated laws.

- We initiate payment by sending a file to the Federal Reserve on the day your payment is due, and your invoice payment is made automatically, without us ever taking ownership of your funds.

Reporting and Insights

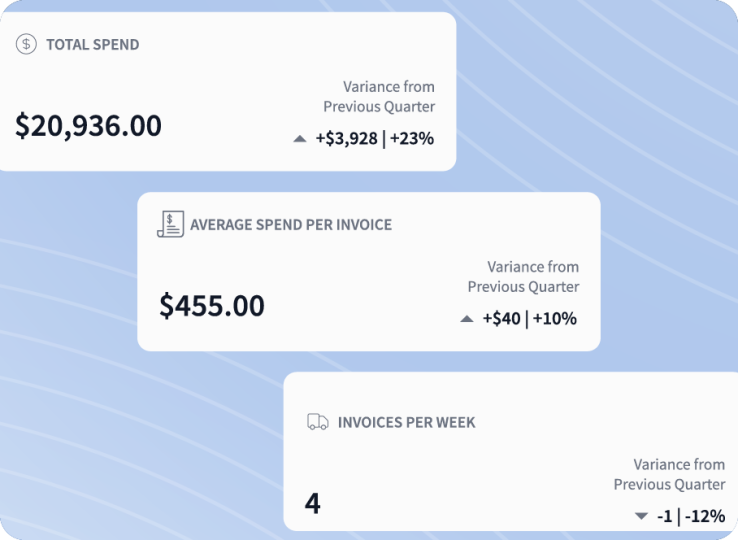

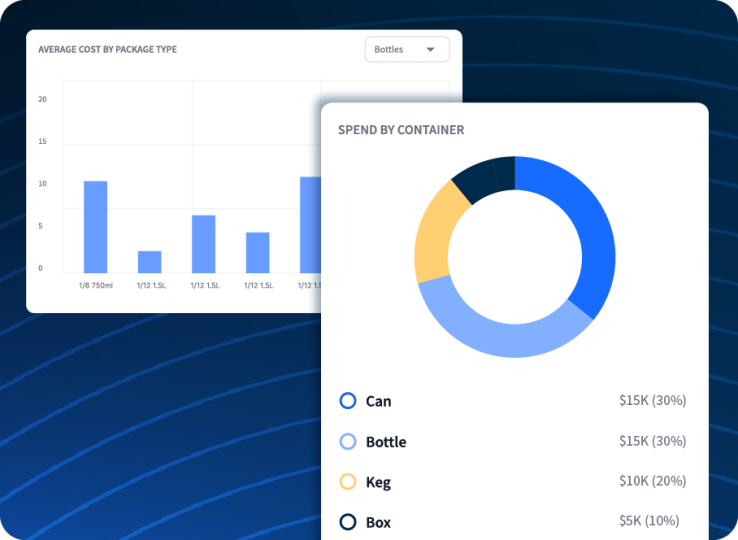

Reporting shouldn’t slow you down. PaymentSource provides built-for-you reporting and insights to deliver the most important metrics upfront. Give your team immediate clarity on spend, distributor & vendor performance and opportunities for improvement.

Track how your total spend, average invoice size, and deliveries change over time with seven interactive widgets for regulated and non-regulated invoices. For example, compare weekly spend or see which product categories and top vendors drive the biggest shifts in your costs.

Gain insights on spending trends across regulated alcohol categories to make smarter purchasing decisions. Easily identify where margins are tightening and adjust pricing or buying quantities before it impacts profits.

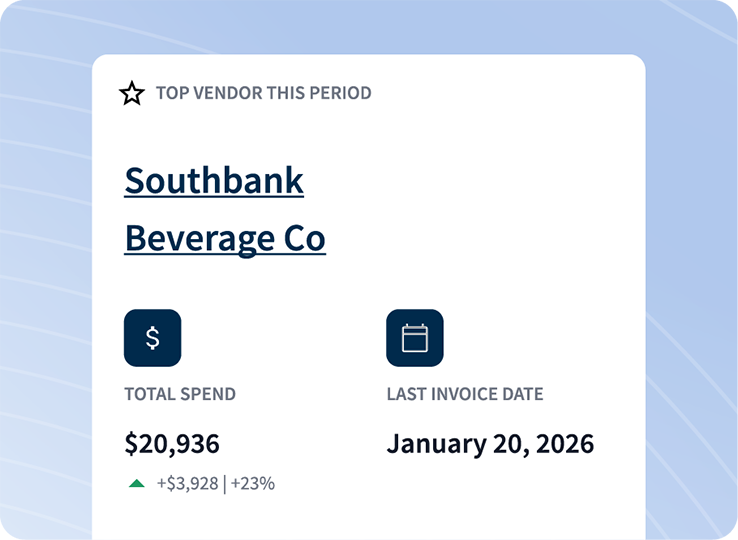

Leverage our Vendor Comparison and Vendor Snapshot tools to negotiate effectively and strengthen partnerships with alcohol distributors. Compare distributor pricing per product category and where cost increases may be affecting your margins.

Cost Variance

Identify which products and locations are driving changes in your cost of goods. View the top 5 products with the largest variances, organize data by category or vendor, and track cost variances across locations with a state-level heat map.

Split Case Fees

Easily identify the costs associated with breaking product cases, a common fee charged by distributors. This report helps you optimize your purchasing, save money, and reduce costs by analyzing your spending patterns and highlighting specific products and locations affected by these fees. (Only available in states with split case-fees.)

Ready to take control of your AP processes?

Rather create an account without speaking to someone?

Retail & hospitality businesses can click here to get started.